Quick commerce, alternatively known as QC or Q Commerce is revolutionizing ways people shop online. The pandemic pushed online sales and today, QC is pushing instant sales. The most affected by this rapidly booming industry are the local kirana stores and local markets, especially in urban areas.

With platforms like Blinkit, Swiggy Instamart, and Zepto rapidly expanding their reach, it’s no surprise that QC appeals to the faced-paced lifestyles of metro cities and its inhabitants. This is further amplified in the emerging consumer behaviours amongst the younger generations. GenZ values time more than money which is in sharp contrast to 1st generation buyers who focus on traditional methods of physical shopping.

In India, quick commerce is active across various pin codes, especially in metropolitan cities such as Delhi, Mumbai, Bengaluru, and Hyderabad. This expansion is driven by the increasing demand for rapid delivery services in urban centers.

However, there is a growing discussion whether quick commerce poses a serious threat to established traditional e-commerce giants like Amazon and Flipkart or does it serve a different purpose altogether? This blog will cover the key differences between the two marketplaces and which one overpowers the other when.

Quick Commerce: What You Need to Know

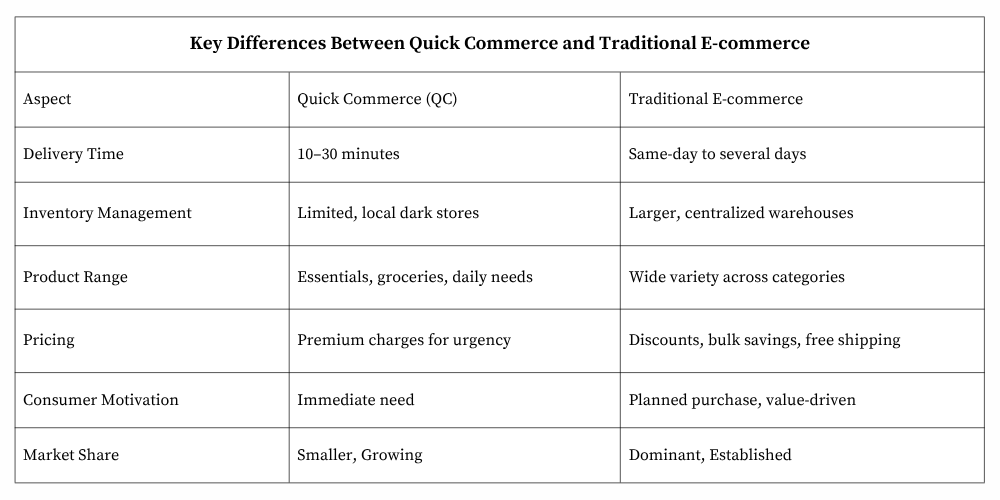

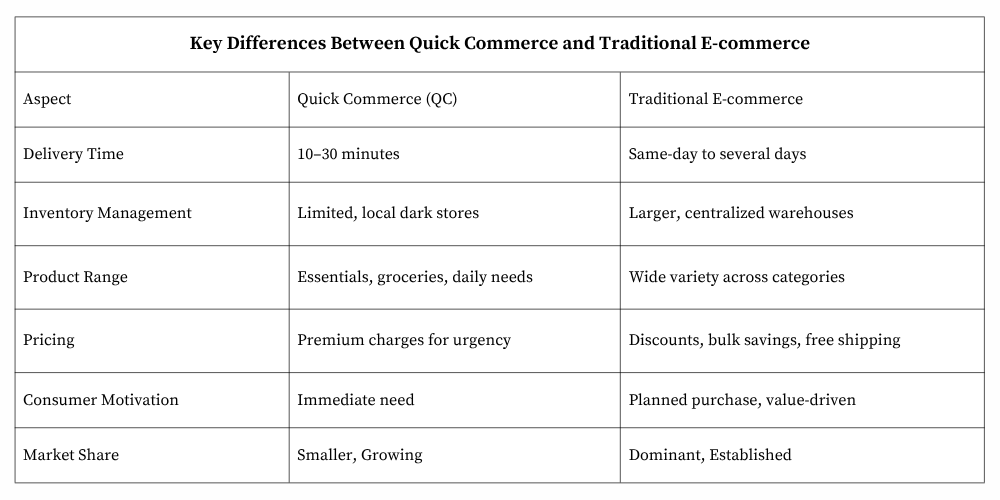

Quick commerce is an extension of traditional e-commerce whose primary purpose is to give ultra fast delivery of goods, typically within 10 to 30 minutes of ordering.

Brands selling on quick commerce platforms are mostly onboarded through an invite-only program. This selective onboarding process means that the availability of specific items or brands is limited in the QC space.

In India, some of the common Quick Commerce apps are Blinkit, Zepto, Swiggy Instamart and Big Basket. As of March 2025, Blinkit leads the market with a 40% share, followed by Zepto at 29% and Swiggy Instamart at 26%. The sector has grown rapidly, with a projected value of $35 billion by 2030.

While all of the platforms run on a primary motive to give fast deliveries, models for each of them differ slightly.

Traditional E-commerce: What You Need to Know

Electronic Commerce or E-commerce is a type of internet commerce to solve your offline shopping problems. When limited market size posed a problem, e-commerce provided a platform to sell and buy from across the globe. This exchange of products and services is facilitated through various online commerce websites and mobile applications of popular platforms like Amazon, Flipkart, Myntra, Meesho, AJIO, Etsy etc.

Unlike QC, traditional e-commerce offers a vast selection of products ranging from electronics and fashion to home essentials and specialized items. Here, products are enlisted with detailed descriptions, user reviews and deals/discounts to attract buyers from various locations. These platforms benefit from well-established supply chains, optimized warehousing solutions, and the ability to ship nationwide and internationally.

Why Quick Commerce Won’t Kill Traditional E-commerce?

While Quick Commerce is booming, it is still a part of E-commerce and does not have the power to overthrow traditional ecommerce. These platforms are designed to cater to a global audience, offering a wide range of products, bulk deals, and extensive logistics networks that QC simply cannot replicate.

Traditional E-commerce Connects You to the World

E-commerce websites like Amazon and Flipkart make the statement “the world is a small place” come true to its value. From anywhere and everywhere, you can list your products online and sell them globally as these e-commerce websites are designed for a seamless seller experience. This allows users to buy products of their choice that aren’t available in nearby stores and explore more to find what suits their needs best. Traditional E-commerce has eased their problem by providing them with convenient solutions to high demand and variety of supply.

On the other hand, QC works on a hyper local delivery system. It has ‘dark stores’ which means mini-warehouses set up closer to its consumers’ residences that ensures products reach consumers within minutes. For example, if you reside in a Tier -1 city like Bangalore and Mumbai, there are high chances that Blinkit and Zepto have dark stores set up near your residence. Since these stores are much smaller compared to large warehouses, only limited shelf space is given to each brand with restricted product options.

Logistical Challenges

Traditional E-commerce has a huge range of products stored at its warehouses. Logistics for them are already streamlined with advanced inventory management systems, efficient supply chains, and well-established delivery networks.

On the other hand, QC, even if they tried to incorporate diversity in their inventories, would struggle logistically. To accommodate a larger inventory into its system, it will lose its core USP i.e. SPEED.

Managing a wider variety of products calls for a much more complex supply chain than the quickly fulfilling limited-category orders. Increased inventory means increased investment in labor, infrastructure, and technology, thereby increasing operational expenses for these sites.

Longer Decision-Making Hurts Conversions

Hypothetically, if QC were to onboard multiple sellers for similar products, the natural tendency of Indian customers would be to spend more time comparing products, prices and reviews.

The more time they spend, the longer they will ponder over the question “whether I should buy this or not” and second guess their decisions.

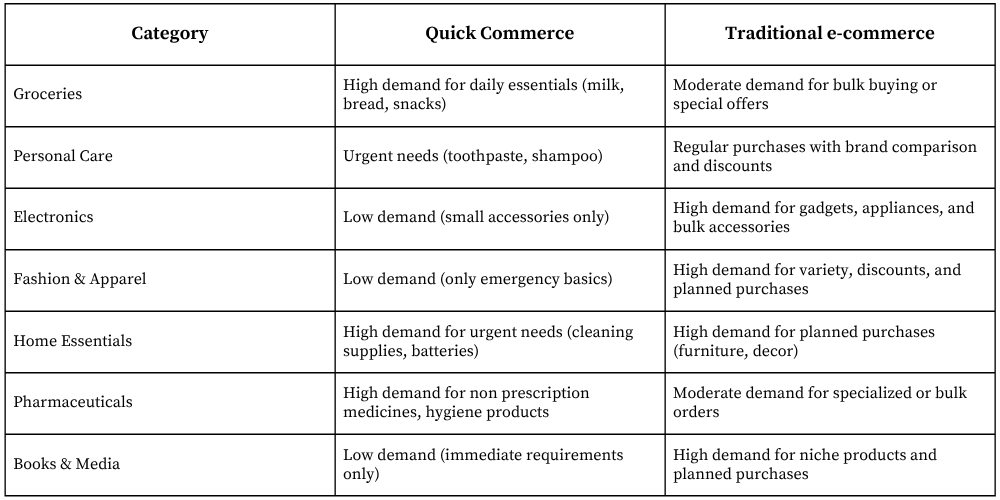

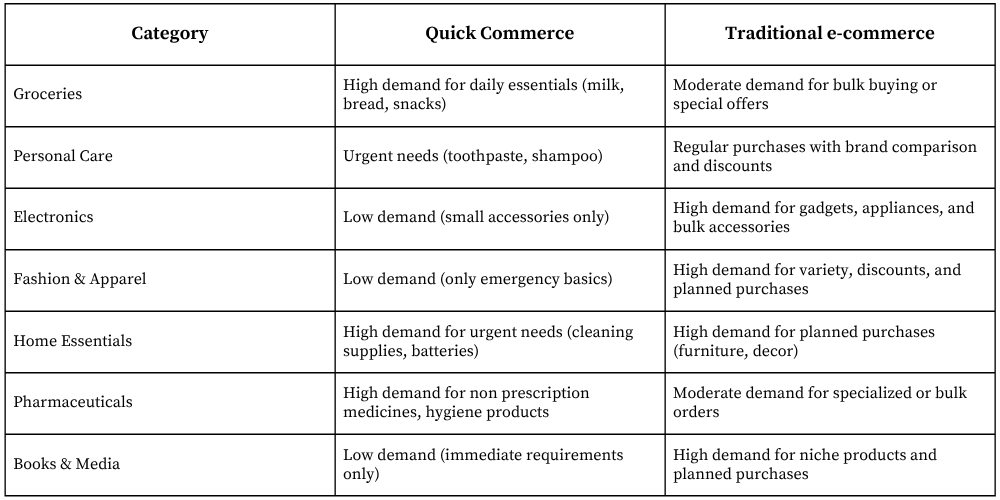

User behavior shows, on QC, it is all about instant needs. Urgency triumphs over research and searches like “milk,” “chips,” or “toothpaste” scream “I need this, now!” Introducing more choices only complicates the decision-making process, elongating the purchase chain and hurting overall conversion rates.

Pricing and Discounts

Even within QC, platforms like Zepto attract customers with free delivery options for smaller order values (e.g., Zepto+ or Zepto offers free delivery on orders above ₹99). This tactic indicates that consumers are still price-sensitive, even when prioritizing speed. Moreover, for high valued goods and planned purchases, consumers will wait for the right time and the right deals. This is one of the reasons why over 200 million people globally have Amazon Prime membership.

Traditional E-commerce caters to this need effectively. They have the bandwidth to give larger discounts and deals on high value products like electronics, apparel, home essentials etc. Customers wait for peak sale periods like Amazon’s Republic Day Sales, Flipkart’s Big Billion Days, etc. so they can get maximum returns on their investments. With bulk savings and free shipping options, ecommerce attracts customers who think finance before need.

Traditional E-commerce Giants Have an Upper Hand with Their QC Extensions

Amazon quick commerce, Amazon Tez is an example of how traditional e-commerce giants are not competing with QC rather they’re integrating it into their existing ecosystems. By leveraging their expansive warehouse networks, they’ve solved 30-40% of the logistics problem already. All Amazon needs now is to enhance their network of Amazon dark stores. Likewise, Flipkart has also ventured into the quick commerce area with Flipkart Minutes, however, it is currently active only in limited cities in India.

This integrated approach allows traditional e-commerce giants to offer ultra-fast deliveries without compromising their primary revenue streams. Meanwhile, existing QC platforms continue to face challenges with technology, finance, and efficiency. Frequent glitches on these platforms highlight the difficulty of scaling the model effectively.

Which platform is the key to growth for brands?

To thrive in this rapidly evolving market, brands must optimize their traditional e-commerce presence for sustained sales while tapping into quick commerce for immediate consumer needs. A balanced approach ensures that brands can cater to both planned and spontaneous purchases effectively.

Moreover, brands should leverage technology and data analytics to identify when their audience prefers QC over standard traditional e-commerce. This understanding can guide marketing strategies, inventory planning, and delivery models that best serve diverse consumer expectations. Here are some trends which we’ve observed on which category works best where.

Final Thoughts

Quick commerce is a powerful tool but it is not a replacement for traditional e-commerce. Instead, it serves as a complementary model that enhances convenience for immediate needs. As long as platforms like Amazon and Flipkart continue to expand, they will remain dominant players in this space.

For brands looking to stay ahead, the secret is to adapt and leverage both platforms. Play on the strengths of Amazon for sustained revenue and experiment with Quick commerce to sell out your most popular products fast.